pa tax payment forgiveness

Pa tax payment forgiveness Sunday May 15 2022 Edit. Jackson Hewitt Can Give You the Help You Need.

Pa Tax Update Good News For Taxpayers In 912m Pandemic Relief Bill

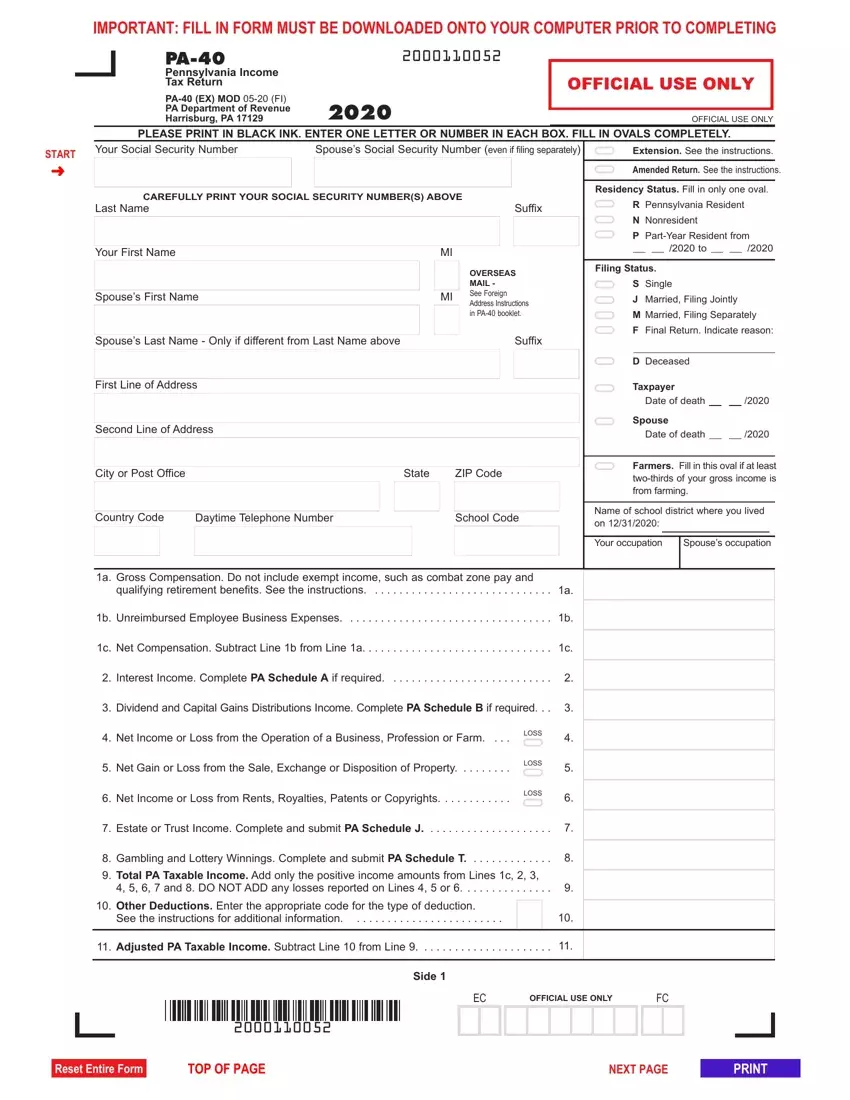

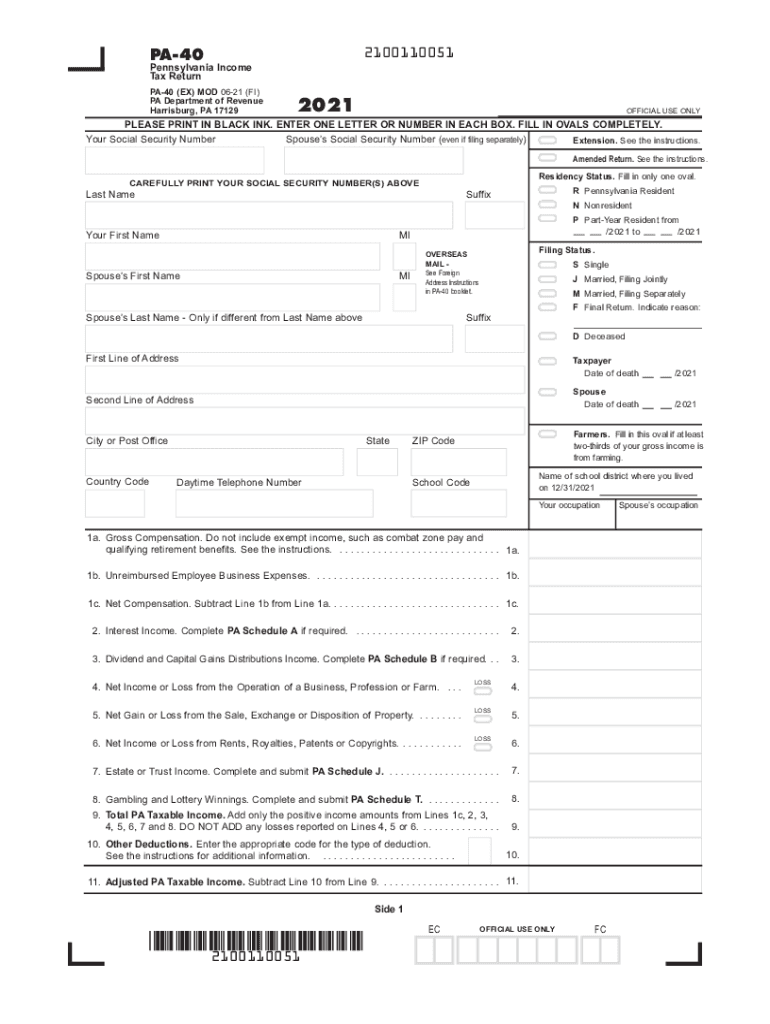

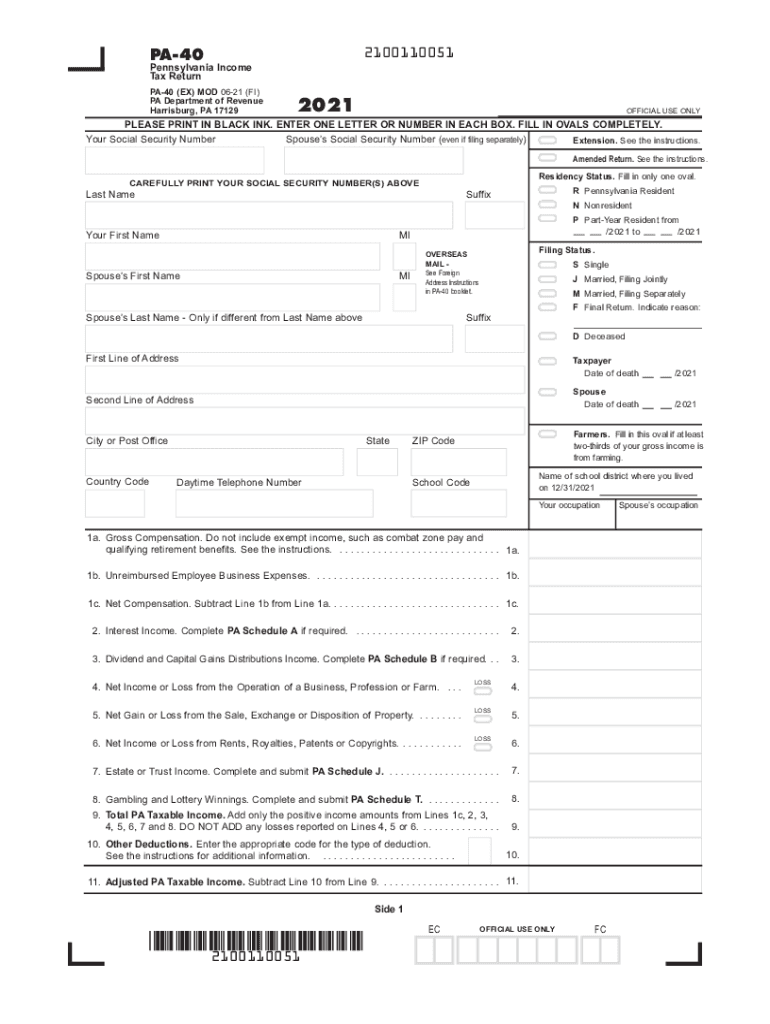

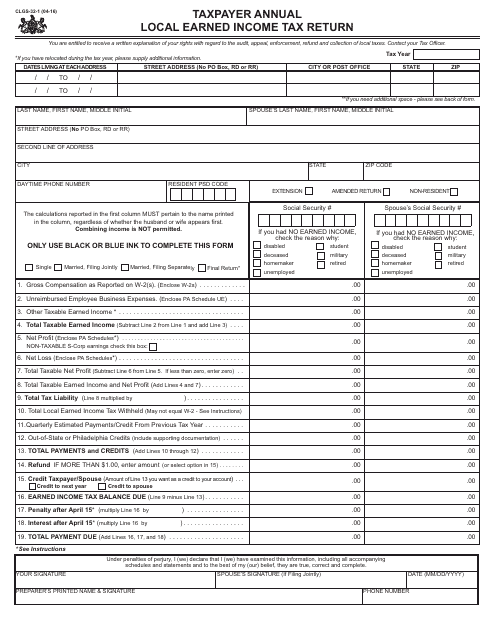

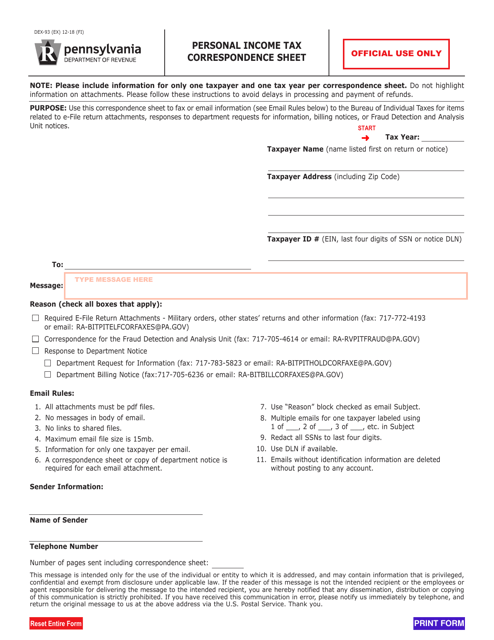

Please consult the PA-40IN booklet for the tax year in question for specific instructions Nonresident income.

. To receive Tax Forgiveness a taxpayer must file a PA personal income tax return PA-40 and complete. Ad Owe back tax 10K-200K. Different from and greater than taxable income.

For more information visit the Internal Revenue Services at www. The Pennsylvania DOR usually requires an upfront payment of 20 of your entire tax debt. The PA DOR refers to tax payment plans as Deferred Payment Plans.

Taxpayers may only claim dependents who are minor or adult children claimed as dependents on their federal income tax returns. See the Top 10 Tax Forgiveness. Act 84 of 2016 changed the taxability of PA lottery winnings.

According to the IRS the refundable tax credit is 50 or. Ad Tax Relief for Business OwnersContractors Who Cant Pay Taxes Owed. No Call Center Service.

Wolf signed Senate Bill 109 into law on Feb. See if You Can ACTUALLY Qualify for Relief. The PICPA-supported PPP loan forgiveness provision was unanimously adopted by both the House and Senate and Gov.

The Pennsylvania Tax Forgiveness Credit helps eligible PA taxpayers reduce their tax liability. No Call Center Service. Provides a reduction in tax liability and.

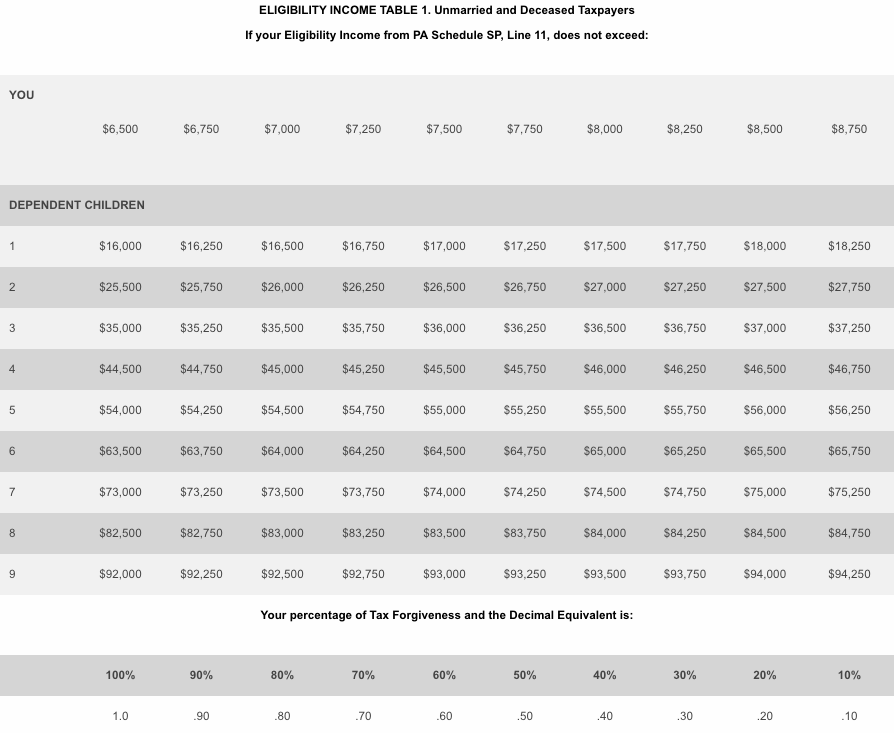

Download or print the 2021 Pennsylvania Form REV-631 Tax Forgiveness for PA Personal Income Tax Brochure for FREE from the Pennsylvania Department of Revenue. A sin- gle-parent two-child family with annual income up to 27750 can also qualify for some Tax. Depending on your income and family size you may qualify for a refund or reduction of your Pennsylvania income tax.

Instead taxpayers are instructed to call the DOR. See if you Qualify for IRS Fresh Start Request Online. Ad Best Tax Relief.

The Pennsylvania Department of Revenue allows individuals and businesses to appeal tax penalties and interest with the Board of Appeals after a notice of assessment has. The more dependent children you have and the less income you make the higher the percentage of tax forgiveness you will. The Employee Retention Credit ERC under the CARES Act encourages businesses to keep employees on their payroll.

Tax forgiveness is a credit that allows eligible taxpayers to reduce all or part of their Pennsylvania personal income tax liability. Find Out Now For Free. Wheres My Income Tax Refund.

Download PA Schedule SP. A tax professional can quickly get you up to date if you have unfiled taxes. Get Instant Recommendations Trusted Reviews.

Property TaxRent Rebate Status. To claim this credit it is necessary that a taxpayer file a PA-40. It ranges from 0 to 100 in 10 increments.

Compare Before You Buy. What is taxpayer forgiveness. However any alimony received will be used to calculate your PA Tax Forgiveness credit.

Nearly one-in-five Pennsylvania households qualifies for Tax Forgiveness. Philadelphia residents who qualify for PAs Tax Forgiveness program can get a partial refund of city wage tax withheld by their employer. Tips for Tax Forgiveness.

Alimony- Alimony payments that you received are not taxable in the state of Pennsylvania. Taxpayers who qualify for PAs Tax Forgiveness program may also qualify for the federal Earned Income Tax Credit program. ELIGIBILITY INCOME TABLE 1.

Provides a reduction in tax liability and Forgives some taxpayers of their liabilities. Ad Best Tax Relief. Dont Let Tax Issues Overwhelm You.

Ad Depending on Your Circumstances You Could Have Some of Your Tax Problems Forgiven. Owe IRS 10K-110K Back Taxes Check Eligibility. The DOR does not have a form that should be filed to establish a DPP.

At the bottom of that column is the percentage of Tax Forgiveness for which you qualify. If your Eligibility Income. Harrisburg PA With the personal income tax filing deadline approaching on May 17 2021 the Department of Revenue is reminding low-income.

Unmarried and Deceased Taxpayers. PA Schedule SP Eligibility Income Tables. Tax Forgiveness is a credit against PA tax that allows eligible taxpayers to reduce all or part of their PA tax liability.

The Pennsylvania Departments guidance is a welcome development for taxpayers looking to clarify the income tax treatment of various CARES Act relief payments. Ad Looking for the Best Tax Forgiveness. Pennsylvania Department of Revenue Online.

To receive Tax Forgiveness you must file a PA income tax return and complete PA Schedule SP. Or call the IRS toll-free 1-800-829-1040. Taxpayers can apply for tax forgiveness by completing a PA Schedule SP along with their state personal income tax return.

Extend Mortgage Cancellation Tax Relief Real Estate Agent And Sales In Pa Mortgage Debt Mortgage Rates Today Mortgage Loan Originator

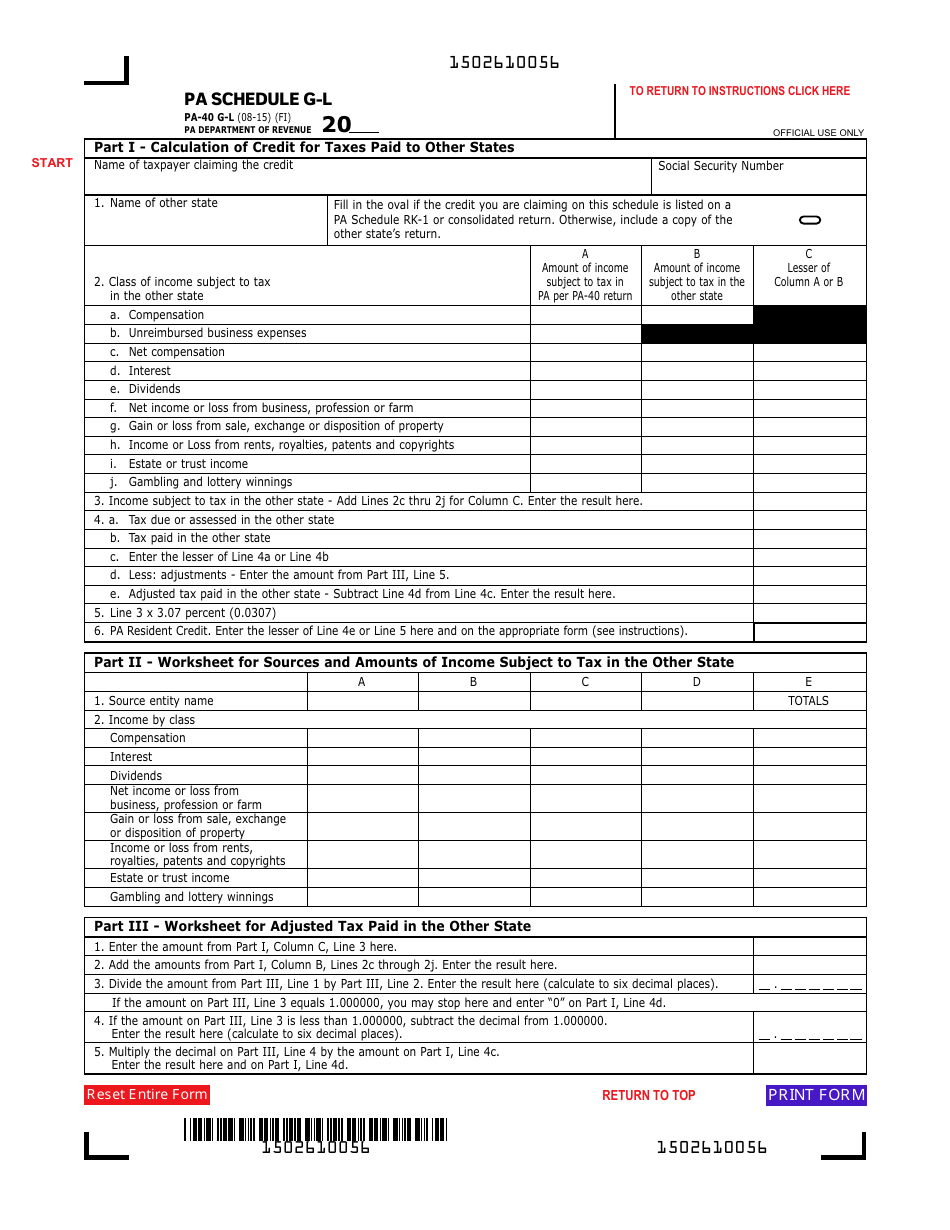

Form Pa 40 Schedule G L Download Fillable Pdf Or Fill Online Resident Credit For Taxes Paid Pennsylvania Templateroller

Low Income Pennsylvanians May Be Missing Out On Pa Tax Refunds Of 100 Or More

2021 Form Pa Dor Pa 40 Fill Online Printable Fillable Blank Pdffiller

Pennsylvania Tax Forms And Templates Pdf Download Fill And Print For Free Templateroller

Pennsylvania House Passes Legislation To Help Make Pennsylvania The Envy Of East Benninghoff Says Pa State Rep Kerry Benninghoff

Form Pa 40sp Pa Schedule Sp Special Tax Forgiveness Pa 40 Sp

Pennsylvania Special Tax Forgiveness Credit Do You Qualify Supermoney

Pennsylvania Tax Forms And Templates Pdf Download Fill And Print For Free Templateroller